- The retail sector seems confident about the back-to-school shopping season in 2023

- And that's to be expected, as back-to-school sales are expected to reach a staggering $135 billion this year

- Four retail stocks are well-positioned to benefit from this trend

It's that time of year again. Back-to-school season is upon us, bringing a wave of expenses for American families.

However, due to the recent drop in inflation, retailers who were initially uncertain about this year's back-to-school sales are now feeling much more confident about the prospects for the shopping season.

The National Retail Federation conducted a survey that indicates 2023 is poised to become the best-ever back-to-school shopping season, with projected purchases surpassing $135 billion. This marks a significant 21.6% increase compared to 2022.

This positive outlook provides a welcomed boost to the retail sector, which has faced challenges over the past year due to the Federal Reserve's interest rate hikes since March 2022.

Additionally, the sharp decline in inflation over the past year, after hitting a 40-year high of 9.1% in June 2022, is likely to have a positive impact on household spending.

Against this backdrop, we have assessed four stocks that are well-positioned to benefit from the back-to-school shopping trends.

Our analysis was conducted considering recent quarterly results, analyst projections, and valuation models using InvestingPro.

1. Amazon

Amazon (NASDAQ:AMZN), the global e-commerce giant, is a go-to destination for back-to-school shopping. However, due to its diverse range of operations, it's important to note that it isn't solely reliant on back-to-school sales.

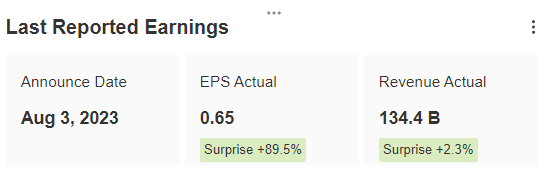

Amazon's share price has risen by over 60% since the start of the year, and investors' conviction in the stock has been reinforced by the recent earnings published on August 23, with EPS of $0.65, 89.5% above analysts' forecasts, and sales 2.4% above consensus.

Source: InvestingPro

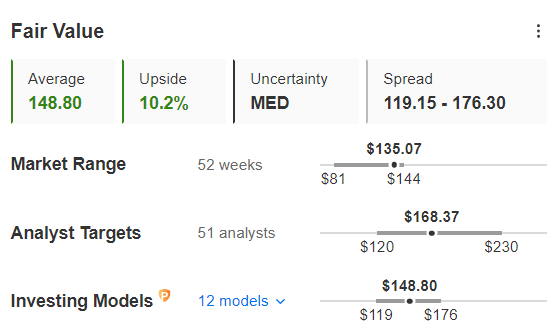

In terms of forecasts, the 51 analysts who follow the stock have set an average target of $168.37, or 24.6% above the current price.

Source: InvestingPro

Furthermore, considering the InvestingPro Fair Value assessment for Amazon stock, which employs a variety of 12 established financial models, the valuation stands at $148.8. This suggests an upside potential of slightly over 10%.

2. Walmart

Walmart (NYSE:WMT), being the largest retailer in the US, is another essential player to consider when looking at stocks that could benefit from back-to-school shopping trends.

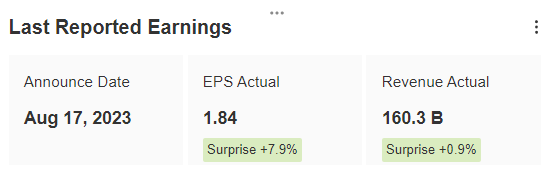

Its recent Q2 earnings report, released on August 17, pleasantly surprised investors. The company's EPS came in at $1.84, which was nearly 8% higher than anticipated. Moreover, its sales also surpassed expectations, albeit by a smaller margin.

Source: InvestingPro

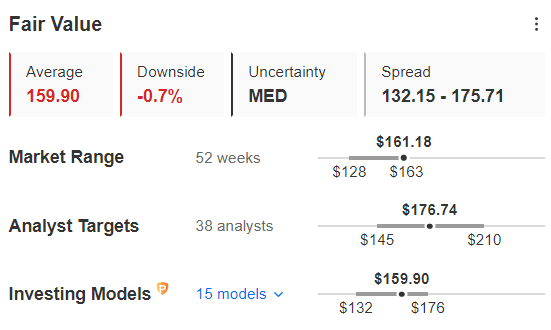

In terms of outlook, analysts are cautiously optimistic about WMT shares, with an average target of $176.74, which translates into a potential upside of 9.6%.

Source: InvestingPro

Walmart's InvestingPro Fair Value, which is an average of 15 recognized financial models, is even more conservative, coming in slightly below the current price of $159.90.

3. Target

Target (NYSE:TGT), a popular back-to-school shopping destination in the United States, is positioned to potentially reap significant benefits from this trend this year.

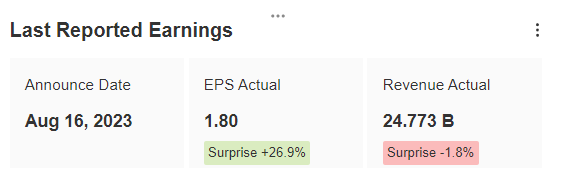

However, it's important to highlight that the most recent quarterly results, announced on August 16, were a bit of a mixed bag. While the company's EPS exceeded consensus estimates by an impressive 26.9%, its sales fell short, coming in nearly 2% below expectations.

Source: InvestingPro

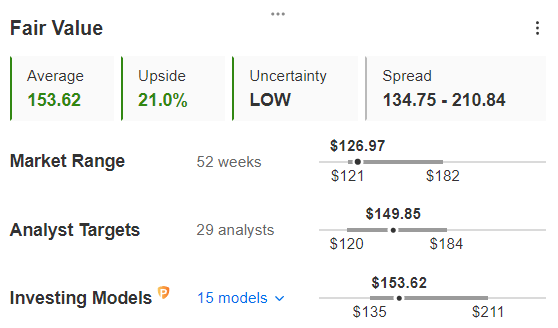

However, this hasn't stopped analysts from remaining optimistic about the stock, with an average target of $149.85, 18% higher than Wednesday's closing price.

Source: InvestingPro

InvestingPro's Fair Value, which is based on recognized financial models, confirms the bullish potential, standing at $153.62, implying a potential upside of 21%.

4. Kohl's

Kohl’s (NYSE:KSS), a prominent retailer, is frequently mentioned as a stock that stands to benefit from early school-year spending.

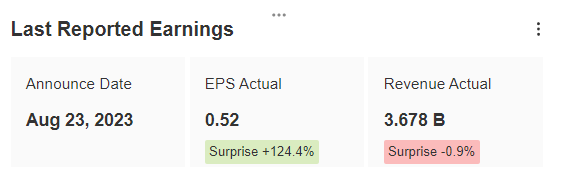

In its Q2 earnings report released on August 23, the company delivered a significant positive surprise, reporting an EPS of $0.52, which was more than double analysts' forecasts. However, sales fell slightly short, coming in nearly 1% below consensus.

Source: InvestingPro

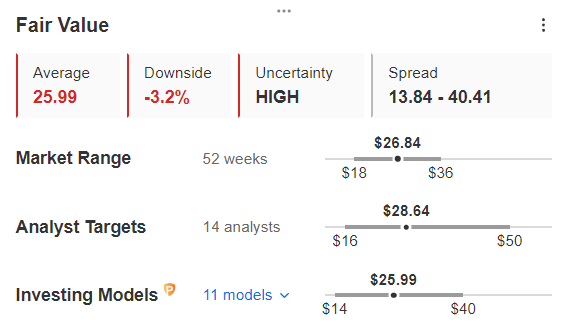

This seems to have cooled analysts' expectations, who see virtually no upside potential for the stock, with an average target of $28.64.

Source: InvestingPro

InvestingPro's Fair Value is even less optimistic, indicating a downward potential of 3.2%.

Conclusion

In conclusion, the back-to-school season brings about a period of heightened spending, potentially favoring numerous companies, including the ones highlighted in this article as significant beneficiaries.

However, back-to-school 2023 also serves as a significant test for US consumer spending, with emerging signs of vulnerability evident in recent July retail sales data.

The performance of retailers in the coming weeks could carry implications extending well beyond this sector.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.