Inflationary Yield Curve Steepening?

Gary Tanashian | Jan 12, 2024 02:08

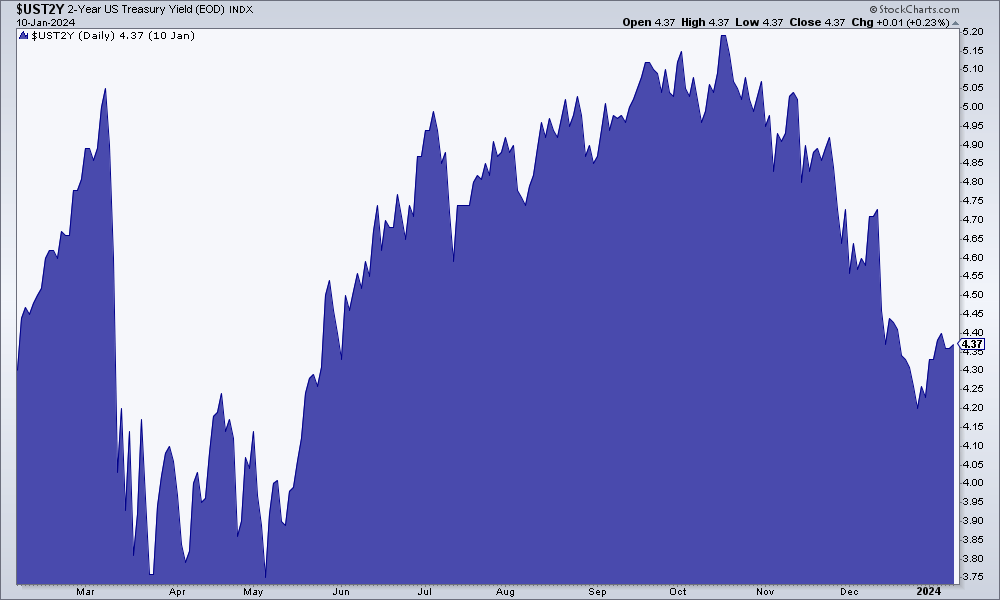

After a gentle disinflationary easing (Goldilocks), the bond market is hinting at an inflationary steepening of the 10-2 Year Treasury Yield Spread.

A yield curve can steepen under inflationary or deflationary pressure.

Inflationary: Generally, long-term yields rise in relation to short-term yields as both rise nominally, or more importantly long-term yields rise nominally.

Deflationary: Short-term yields decline in relation to long-term yields, as both decline nominally.

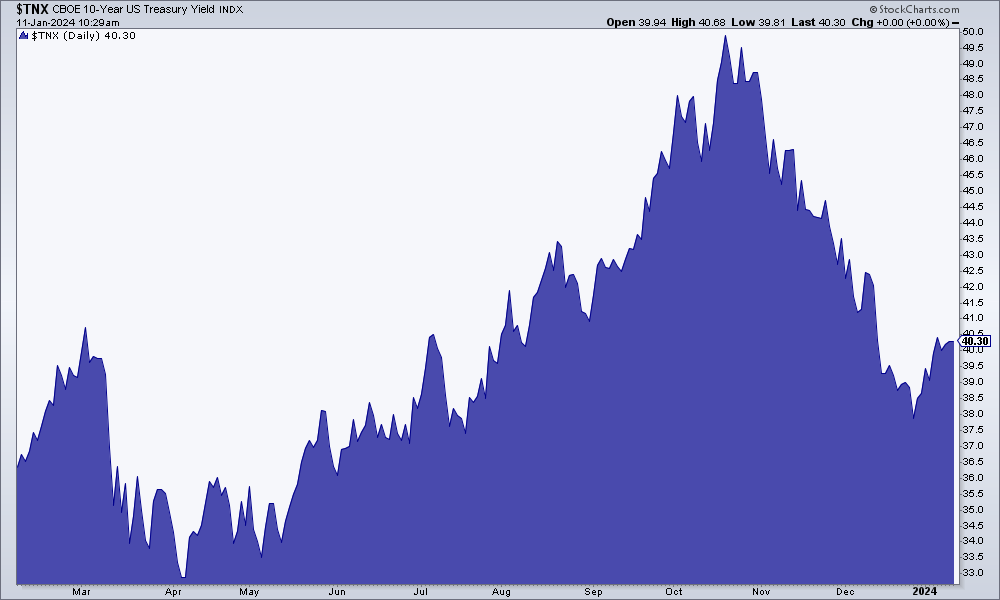

Thus far during the Goldilocks phase from the stock market lows in October, the signal has been disinflationary relief as the 10-year Treasury bond yield dropped from near 5% to 3.8%.

The yield curve, which is the product of the two yields above, shows the steepener still in progress after we noted in last week’s article that the recent Goldilocks-friendly easing in the curve was merely a consolidation on the way to further steepening.

Today the break from consolidation is furthered and the steepening continues. It continues with the nominal yields shown above rising. Hence, a little inflationary hint that will obviously need follow-through in order to play out.

The decline in yields from October to December represented the best Goldilocks had to offer in 2023 as our original thesis of pleasant disinflation played out, Goldilocks style, at various times in 2023. It was a perfect accelerant for the anticipated seasonal (Q4) party atmosphere, built on relief from a hawkish Fed as inflation signals faded from the macro.

Last weekend in NFTRH 791, we began a very preliminary theme whereby the writer did not want to get caught in a self-congratulatory feedback loop, due to the correct disinflationary/Goldilocks call a year ago. With the caveats of a still-bouncing US dollar and a bull-poised Gold/Silver ratio, the following was noted in the report’s opening Summary segment:

Consider this; what are commonly referred to as the “inflation trades” in commodity and resources related speculations, have already been hammered, much like the 2020 disinflation stuff like ARK funds and Cloud/SaaS got croaked prior to Goldilocks, which re-lifted those boats. If the macro flips inflationary – even if only for a phase – the nearly sunken ‘inflation trade’ boats could sail again… for a phase, at least.

It is still very preliminary analysis. But my spidey sense says ‘Gary, don’t over-stay your disinflationary view’. Now let’s see if the indicators back that notion up. If the yield curve resumes its steepening as expected and if that steepening is inflationary, as has been the little hint since mid-December, those confident about a Goldilocks style soft landing will be disappointed and maybe even those willing to deploy trades in the opposite direction of 2023’s disinflationary backdrop may find success.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.